Downtown Adaptive Reuse Program

Part of the Future of Downtown initiative

In July 2023, the City of San Francisco established a new Commercial to Residential Adaptive Reuse Program. In accordance with the Roadmap to San Francisco’s Future, the program is intended to facilitate the expansion of housing downtown by waiving certain Planning Code requirements.

Announcement: The Downtown Revitalization Financing District is now accepting applications for commercial-to-residential conversion projects!

In July 2023, the City of San Francisco established a new Commercial to Residential Adaptive Reuse Program Ordinance No. 159-23. The program is intended to facilitate the expansion of housing downtown by waiving certain Planning Code requirements for projects which meet certain eligibility criteria, pursuant to Planning Code Section 210.5.

In addition, new financial incentives are in place to support economic feasibility of adaptive reuse projects including, real estate transfer tax waiver, inclusionary housing and impact fee waiver and/or property tax incentive payments.

Definition

Commercial to Residential Adaptive Reuse shall mean to change the use of an existing Gross Floor Area from a non-residential use, other than a hotel use, to a residential use pursuant to Section 210.5.

Eligibility

To be eligible for the Commercial to Residential Adaptive Reuse Program a project must:

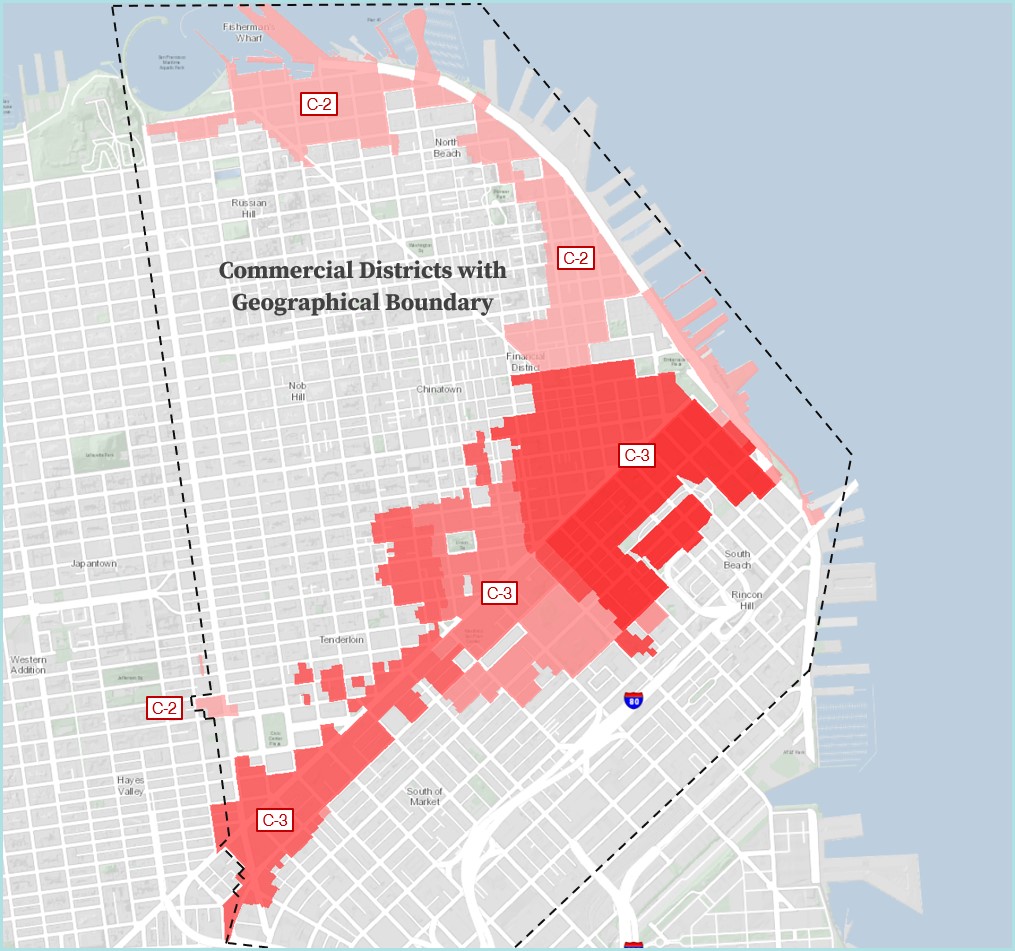

- Located in C-3 zoning district or C-2 zoning district that is east of or fronting Franklin Street/13th Street and north of Townsend Street

and - Not seek approval under Section 206.5 or 206.6. (State Density Bonus)

Planning Code Waivers

Projects which meet the eligibility criteria, could receive zoning modifications (or waivers) from some Planning Code requirements:

- Lot coverage (Sec. 134)

- Open space (Sec. 135)

- Streetscape and pedestrian improvements (Sec. 138.1)

- Dwelling Unit Exposure (Sec. 140)

- Bike parking (Sec. 155.1)

- Dwelling unit mix (Sec. 207.7)

- Live Work and Intermediate Length Occupancy uses would be permitted.

- Transportation Demand Management (TDM) Plan Requirements (Sec. 169)

- Off-street loading (Sec. 152 and 152.1)

- Protected Pedestrian, Cycling, and Transit-Oriented Street Frontages (Sec. 155 (r))

- Planning Commission Hearing (Sec. 309)

- POPOS required per Section 210.5

The Planning Code waivers can also apply to an expansion of the building. A project may add up to 33% additional volume. The waivers could be applicable to both the existing building and the expansion.

Building Code Provisions

The San Francisco Department of Building Inspection (DBI) has outlined pertinent code provisions and possible code exceptions to facilitate adaptive reuse projects. In September 2024, DBI published the Commercial-to-Residential Adaptive Reuse Information Sheet which clarifies Building and Fire Code requirements and alternative methods of compliance for adaptive reuse projects. View the Office to Residential resource guide.

State Programs

Commercial to Residential Adaptive Reuse Program projects may be eligible for various State ministerial programs provided that all of the eligibility criteria are met. Please see the Ministerial Programs website for additional information. State ministerial program projects must be code-complying. Although Commercial to Residential Adaptive Reuse Program projects may not take advantage of State Density Program, relief from Planning Code requirements are available by use of specific Planning Code waivers included in this program. A Commercial to Residential Adaptive Reuse Program project that requests waivers as specified in this program may still be considered code-complying.

Financial Incentives

- Transfer Tax Waiver (Proposition C) passed in March 2024 waives the real estate transfer tax on up to 5 million square feet of eligible commercial-to-housing conversion projects throughout the City.

- Inclusionary Housing Requirements and Impact Fees Waivers passed March 2025 (Board File 240927) waives the inclusionary housing requirement and impact fees on up to 7 million square feet of eligible adaptive reuse projects located in the area covered by the Commercial to Residential Adaptive Reuse Program.

- The Downtown Revitalization and Economic Recovery Financing District (“Downtown Revitalization District” or “District”) was established effective February 12, 2026 pursuant to Division 8 of Title 6 of the California Government Code (“Downtown Revitalization Law”) enacted by AB 2488 in 2024. The District allows eligible projects to reinvest incremental property tax revenue to offset a significant share of the development costs.

- Downtown Adaptive Reuse Brochure

- Commercial to Residential Adaptive Reuse Projects Supplemental Application

- Directors Bulletin 12: Downtown Commercial to Residential

- Planning and Building Codes - Commercial to Residential Adaptive Reuse and Downtown Economic Revitalization, Ordinance 122-23

- Department of Building Inspection (DBI), Adaptive Reuse Information Sheet and Resource Guide

- Downtown Revitalization, A ULI Advisory Services Panel Report, ULI, October 2023

- From Workspace to Homespace, SPUR, October 2023

Lily Langlois

Principal Planner

lily.langlois@sfgov.org